Delph company uses a job order costing system – Delph Company’s adoption of a job order costing system takes center stage in this exploration, where we delve into the intricacies of this method and its profound impact on the company’s operations. As we unravel the complexities of job order costing, we shall uncover its advantages, challenges, and real-world applications, providing a comprehensive understanding of its significance in Delph Company’s success.

The subsequent paragraphs will delve into the specifics of Delph Company’s job order costing system, tracing the flow of costs through its various stages. We will examine the methods employed to accumulate and assign costs to individual jobs, as well as the strategies used to track and allocate overhead expenses.

Job Order Costing System Overview: Delph Company Uses A Job Order Costing System

A job order costing system is a cost accounting method used to accumulate and assign costs to individual jobs or projects. It is typically used in industries where production is unique and each job has its own distinct set of requirements, such as construction, engineering, and custom manufacturing.

The main purpose of a job order costing system is to provide detailed cost information for each job, which can be used for:

- Cost control and profitability analysis

- Pricing decisions

- Inventory valuation

Advantages of using a job order costing system include:

- Accurate cost tracking for individual jobs

- Improved cost control and profitability analysis

- Enhanced decision-making based on job-specific cost data

Disadvantages of using a job order costing system include:

- Complexity and time-consuming process

- Requirement for accurate and timely cost data

- Potential for errors and inaccuracies

Delph Company’s Job Order Costing System

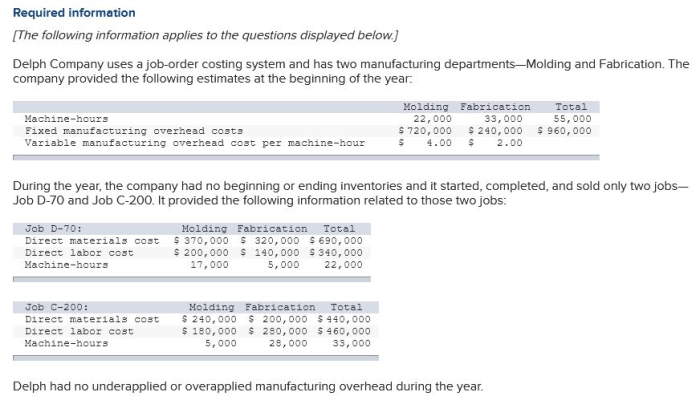

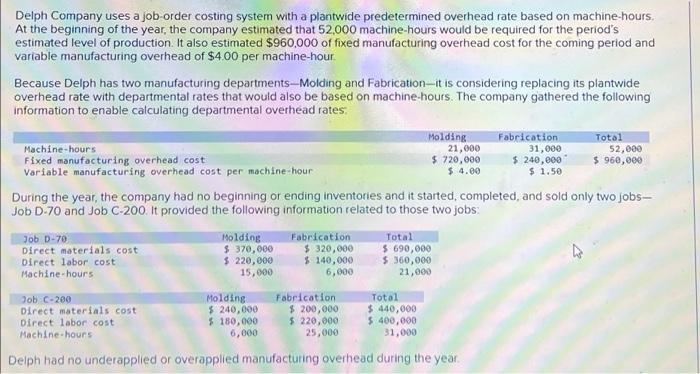

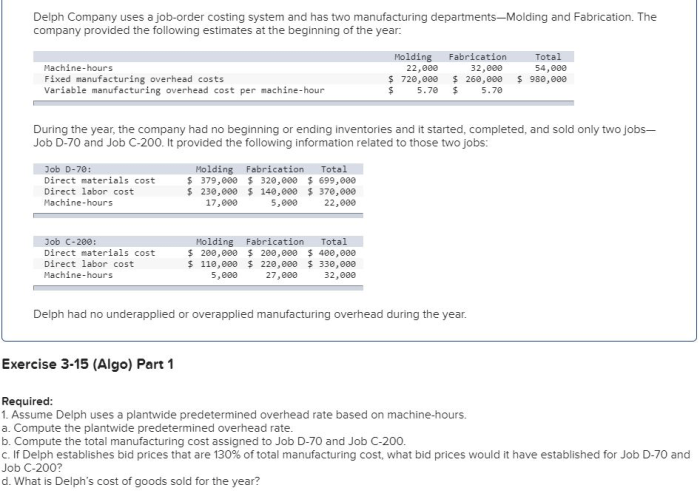

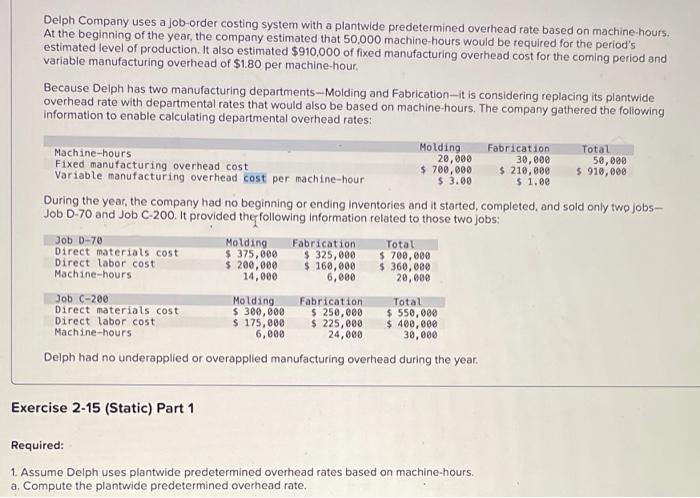

Delph Company uses a job order costing system to track and assign costs to its custom manufacturing jobs. The system accumulates costs for each job in three main categories:

- Direct materials

- Direct labor

- Overhead

Direct materials are materials that can be directly traced to a specific job, such as raw materials and components. Direct labor is the labor cost of employees who work directly on a specific job. Overhead costs are indirect costs that cannot be directly traced to a specific job, such as rent, utilities, and depreciation.

Delph Company uses a predetermined overhead rate to allocate overhead costs to jobs. The overhead rate is calculated by dividing the total estimated overhead costs for a period by the total estimated direct labor hours for the period.

Cost Flow in a Job Order Costing System

The flow of costs through a job order costing system can be illustrated as follows:

| Cost Element | Cost Flow |

|---|---|

| Direct materials | Raw materials inventory → Work in process inventory |

| Direct labor | Factory payroll → Work in process inventory |

| Overhead | Overhead costs → Work in process inventory |

| Total job cost | Work in process inventory → Finished goods inventory |

Job cost sheets are used to track costs for individual jobs. Each job cost sheet contains detailed information about the direct materials, direct labor, and overhead costs that have been assigned to the job.

Job Costing vs. Process Costing

Job order costing and process costing are two different methods of cost accounting. Job order costing is used to accumulate and assign costs to individual jobs or projects, while process costing is used to accumulate and assign costs to a continuous flow of production.

The key differences between job order costing and process costing are as follows:

- Job order costing is used for unique and distinct jobs, while process costing is used for continuous production.

- Job order costing accumulates costs for each individual job, while process costing accumulates costs for a period of time.

- Job order costing uses job cost sheets to track costs for individual jobs, while process costing uses cost sheets to track costs for a period of time.

Process costing is typically used in industries where production is standardized and repetitive, such as food processing, chemical manufacturing, and textile manufacturing.

Query Resolution

What are the key benefits of job order costing?

Job order costing offers several advantages, including enhanced cost control, improved job profitability analysis, and accurate project costing.

What challenges are associated with job order costing?

Job order costing presents challenges such as the need for accurate cost data, the potential for errors, and the complexity of overhead allocation.

How does Delph Company accumulate costs in its job order costing system?

Delph Company utilizes various methods to accumulate costs, including time tickets for direct labor, material requisitions for direct materials, and overhead application rates for indirect costs.