Prepare and analyze a merchandiser’s multi step income statement – Prepare and analyze a merchandiser’s multi-step income statement, an essential financial tool that provides valuable insights into a company’s financial performance. This guide will delve into the intricacies of preparing, analyzing, and interpreting a multi-step income statement, empowering readers to make informed business decisions and enhance financial performance.

By understanding the components and significance of a multi-step income statement, merchandisers can gain a clear picture of their revenue, expenses, and profitability. This comprehensive analysis enables them to identify areas for improvement, optimize operations, and maximize financial success.

Understanding a Multi-Step Income Statement

A multi-step income statement is a financial report that summarizes a company’s financial performance over a specific period, typically a quarter or a year. It provides a detailed breakdown of the company’s revenues, expenses, and net income, and it is an essential tool for understanding a company’s financial health.

The components of a multi-step income statement include:

- Revenue: This is the total amount of money that a company generates from the sale of its products or services.

- Cost of goods sold (COGS): This is the cost of producing the products or services that a company sells.

- Gross profit: This is the difference between revenue and COGS.

- Operating expenses: These are the expenses that a company incurs in the course of its normal operations, such as salaries, rent, and utilities.

- Net income: This is the amount of money that a company has left over after all of its expenses have been paid.

The purpose of a multi-step income statement is to provide a clear and concise overview of a company’s financial performance. It can be used to track a company’s progress over time, to compare its performance to that of other companies, and to make informed decisions about the company’s future.

Preparing a Multi-Step Income Statement

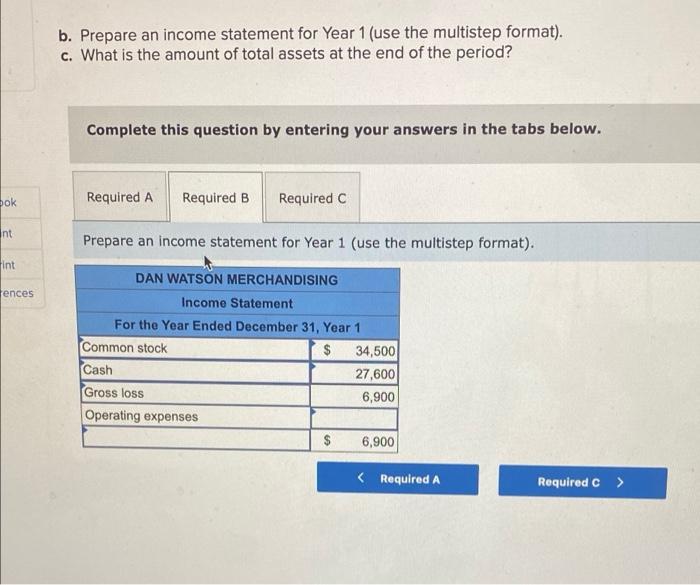

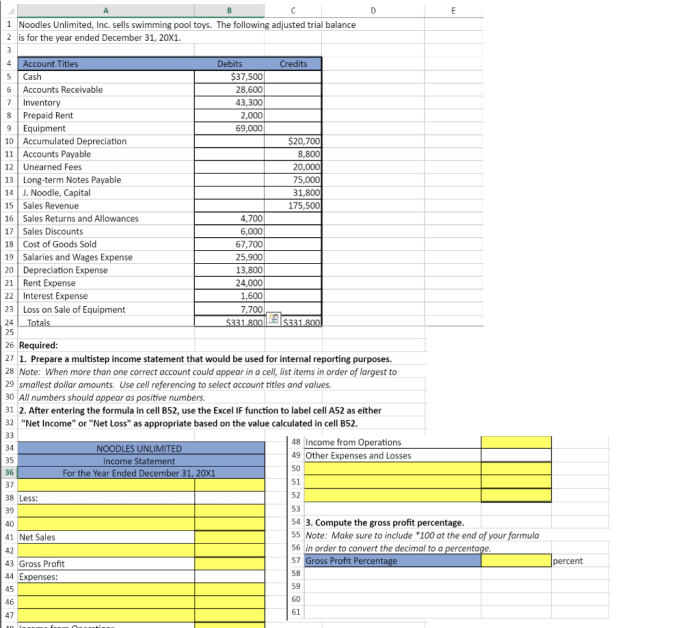

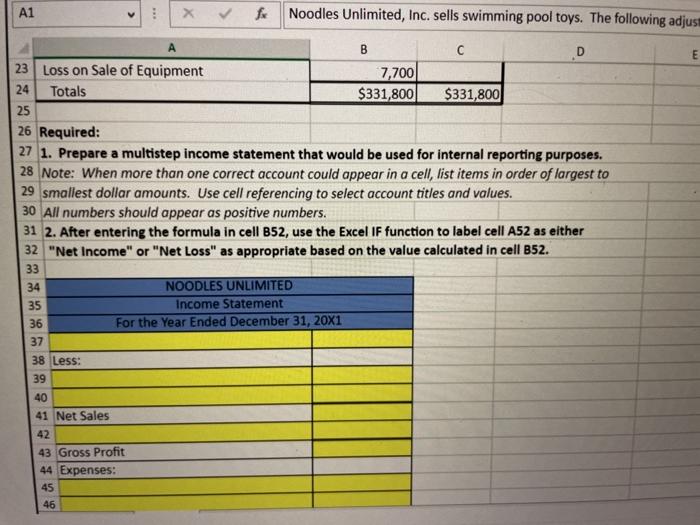

The steps involved in preparing a multi-step income statement are as follows:

- Gather financial data: The first step is to gather all of the financial data that you will need to prepare the income statement. This data includes information on revenue, COGS, operating expenses, and net income.

- Organize the data: Once you have gathered all of the financial data, you need to organize it so that it can be easily used to prepare the income statement. This involves creating a chart of accounts and assigning each item of data to the appropriate account.

- Calculate gross profit: The next step is to calculate the company’s gross profit. Gross profit is the difference between revenue and COGS.

- Calculate operating expenses: The next step is to calculate the company’s operating expenses. Operating expenses are the expenses that a company incurs in the course of its normal operations, such as salaries, rent, and utilities.

- Calculate net income: The final step is to calculate the company’s net income. Net income is the amount of money that a company has left over after all of its expenses have been paid.

Once you have completed these steps, you will have prepared a multi-step income statement. This income statement can be used to track the company’s progress over time, to compare its performance to that of other companies, and to make informed decisions about the company’s future.

Analyzing a Multi-Step Income Statement

There are a number of ways to analyze a multi-step income statement. Some of the most common methods include:

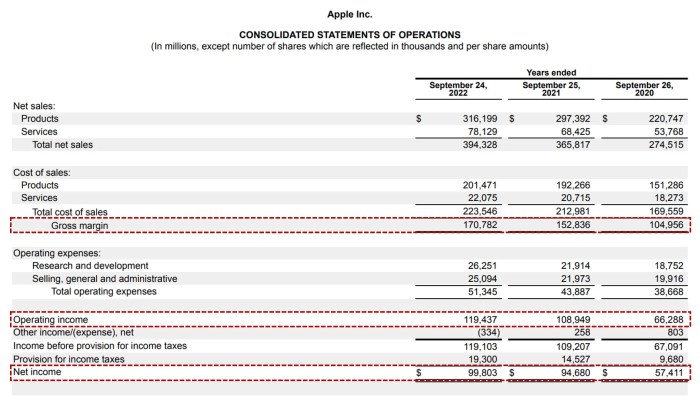

- Analyzing revenue: One way to analyze a multi-step income statement is to look at the company’s revenue. Revenue is the total amount of money that a company generates from the sale of its products or services. You can analyze revenue by looking at the company’s sales growth, its market share, and its customer base.

- Analyzing cost of goods sold: Another way to analyze a multi-step income statement is to look at the company’s cost of goods sold. COGS is the cost of producing the products or services that a company sells. You can analyze COGS by looking at the company’s raw material costs, its labor costs, and its overhead costs.

- Analyzing operating expenses: You can also analyze a multi-step income statement by looking at the company’s operating expenses. Operating expenses are the expenses that a company incurs in the course of its normal operations, such as salaries, rent, and utilities.

You can analyze operating expenses by looking at the company’s SG&A expenses, its R&D expenses, and its marketing expenses.

- Analyzing net income: Finally, you can analyze a multi-step income statement by looking at the company’s net income. Net income is the amount of money that a company has left over after all of its expenses have been paid. You can analyze net income by looking at the company’s profit margin, its return on assets, and its return on equity.

By analyzing a multi-step income statement, you can gain a better understanding of a company’s financial performance. This information can be used to make informed decisions about the company’s future.

Interpreting and Using the Results of the Analysis: Prepare And Analyze A Merchandiser’s Multi Step Income Statement

Once you have analyzed a multi-step income statement, you need to interpret the results of your analysis. The results of your analysis can be used to make informed decisions about the company’s future. Some of the ways that you can use the results of your analysis include:

- Identifying trends and patterns: One way to use the results of your analysis is to identify trends and patterns in the company’s financial performance. These trends and patterns can be used to make predictions about the company’s future performance.

- Making decisions about the company’s future: The results of your analysis can also be used to make decisions about the company’s future. For example, you can use the results of your analysis to decide whether to invest in the company, to lend money to the company, or to buy the company’s products or services.

- Improving the company’s financial performance: The results of your analysis can also be used to improve the company’s financial performance. For example, you can use the results of your analysis to identify areas where the company can cut costs, to increase revenue, or to improve its operating efficiency.

By interpreting and using the results of your analysis, you can gain a better understanding of a company’s financial performance and make informed decisions about the company’s future.

Top FAQs

What is the purpose of a multi-step income statement?

A multi-step income statement provides a detailed breakdown of a company’s revenue, expenses, and profits, allowing for a comprehensive analysis of financial performance.

How can I prepare a multi-step income statement?

To prepare a multi-step income statement, gather financial data, calculate gross profit, operating expenses, and net income, and present the information in a structured format.

What are some key financial ratios used in analyzing a multi-step income statement?

Common financial ratios include gross profit margin, operating profit margin, and net profit margin, which provide insights into profitability and efficiency.